THE HISTORY OF Vienna Insurance Group

VIG is part of a century-long development of a group with tradition and competence in the financial protection of risks. It has successfully developed from an Austrian to an internationally active insurance group with a focus on Central and Eastern Europe.

emergence of the Group in the Habsburg Monarchy from 1824 onwards

The roots of the Group date back to 1824. On 24 December 1824, the "Wechselseitige k.k. privilegierte Brandschaden Versicherungs-Anstalt" was founded, the first of three predecessor companies from which today's Group emerged. Economically, this period of the Habsburgs’ reign was marked by the beginning of industrialisation. The insurance industry was still in its nascence but was already experiencing its first founding boom. Due to the wooden construction techniques that prevailed at that time, the initial focus of these insurance companies was on fire insurance.

The founder of the first predecessor company was Georg Ritter von Högelmüller, an Imperial Army officer. He wanted to transfer the idea of a fire insurance company, which he knew from the Kingdom of Saxony, to Austria. After long difficulties - he had already submitted the first proposals to the estates of individual crown lands in 1803 - he received a licence for the "Wechselseitige", as the company was soon called, in 1824. The founding of the "Wechselseitige" involved 364 public figures from nobility, industry and the church, including the Prince Archbishop of Vienna and the Administrator of the Archdiocese of Salzburg. This laid the foundation for the good relations that still exist today between the Vienna Insurance Group and the Catholic Church.

In 1839, the second predecessor company of the Group, the "Allgemeine wechselseitige Capitalien- und Rentenversicherungsanstalt" in Vienna, started its business activities. The first Austrian life insurance company was founded by mathematics professor Josef Salomon. The company was later renamed "Janus wechselseitige Lebensversicherungs-Anstalt". The company established itself in all regions of the Monarchy in the mid-1960s. Branches were also established in some German principalities, including one in Berlin.

In 1898, the third predecessor company was founded under the name "Städtische Kaiser Franz Joseph- Jubiläums- Lebens- und Renten-Versicherungs-Anstalt". The impetus for its establishment was the 50th year jubilee of Emperor Franz Joseph. For this purpose, Vienna, as the imperial capital and royal residence, implemented a number of measures, including the establishment of a municipal pension institution. On 1 December 1898, the ceremonial opening of the "Städtische" took place in the Vienna City Hall. The company, which soon expanded its activities to Austria’s other provinces, had its headquarters in the building of the Bürgerspitalfonds (Citizens’ Hospital Fund) at Schottenring 30 in Vienna's first district. In 1914, the insurance company moved to a newly built house in the Tuchlauben in Vienna's first district. The aim of the company was to offer life and pension insurance policies to low-income citizens. The company was also involved in the city’s welfare programs.

Engraving of Georg Ritter von Högelmüller, founder of fire insurance in Austria image opens in an overlay

Engraving of Georg Ritter von Högelmüller, founder of fire insurance in Austria image opens in an overlay

historical picture in black and white of Building of Citizens' Hospital Fund image opens in an overlay

historical picture in black and white of Building of Citizens' Hospital Fund image opens in an overlay

Historic building at Tuchlauben image opens in an overlay

Historic building at Tuchlauben image opens in an overlay

The Path to the Merger in the First Republic of Austria

After the collapse of the Danube Monarchy and the founding of the Republic of Austria, the "Städtische Kaiser Franz Joseph-Jubiläums-Lebens- und Renten-Versicherungs-Anstalt" was renamed "Gemeinde Wien - Städtische Versicherungsanstalt" in 1919. Step by step, the business field was expanded to include all insurance lines, including the takeover of an equity stake of the "Union Versicherungs-Aktiengesellschaft" in 1929 and assuming the management of the "Wechselseitige Krankenversicherungsanstalt" in 1935. In 1924, the two other predecessor companies were merged to form the "Wechselseitige Brandschaden und Janus allgemeine Versicherungs-Anstalt auf Gegenseitigkeit". Thus a leading fire insurance company and a leading life insurance company had been combined to create a powerful and large universal insurance company. In 1938, all the predecessor companies were finally merged into one company.

National Socialism and subsequent reconstruction

The collapse of the Austrian economy in the wake of World War II left "Wiener Städtische" on the verge of ruin. Direct bomb hits had totally destroyed the insurance company’s two office buildings on Kärntner Ring along with valuable inventory and documentation. In April of 1945, the company archive had also fallen victim to flames. After the end of the war, a small group of employees began the reconstruction. Two years later, in 1947, the company renamed itself "Wiener Städtische Wechselseitige Versicherungsanstalt".

During the period of rebuilding, Wiener Städtische's headquarters were initially located in the Tuchlauben in Vienna's city centre, but the premises there quickly proved too small for the growing company. In 1952, architect Erich Boltenstern was commissioned to construct a modern office building.

At the intended location on the corner of Schottenring and the Kai, the so-called Bürgerspitalfondshaus had stood for a long time until it was completely destroyed towards the end of World War II and demolished in 1945. The Ringturm thus went up at precisely the spot where one of Vienna Insurance Group’s institutional predecessors, the "Städtische Kaiser Franz Joseph-Jubiläums-Lebens- und Renten-Versicherungs-Anstalt", had had its first headquarters. Construction began on 1 June 1953, and the Ringturm was officially opened on 14 June 1955. The opening took place barely a month after the signing of the State Treaty and Austria's regained sovereignty. The Ringturm thus became a symbol of the completed reconstruction, the rise of Vienna as a cosmopolitan city, and the city's new landmark.

"Wirtschaftswunder" changes insurance needs

The insurance industry was able to profit particularly strongly from Austria's economic rise after the State Treaty. In 1958, Austrians spent about 30 euros per capita per year on insurance, today it is about 2,000 euros per year. With the economic upswing and the "Wirtschaftswunder" ("economic miracle") of the 1950s and 1960s, the prosperity of the population increased. This also changed the importance of the various types of insurance classes. While fire and storm insurance still had priority until the first few post-war years, the protection of newly created values moved to the fore. In 1965, Wiener Städtische brought the first comprehensive household and homeowner's insurance to market.

One of the most important changes in the insurance market had to do with third-party liability vehicle insurance. Such insurance had already become mandatory in Austria in 1929. With increasing motorisation, it then quickly became the dominant type of insurance in the post-war period. As early as 1963, Wiener Städtische awarded a ten percent bonus on the annual premium to those policyholders who had been continually insured with them since 1960 and not been responsible for an accident in either of the two preceding years. With this innovative idea, the insurance company was far ahead of its time and its competitors. It was not until August 1977 that the bonus-malus system, which is still valid today, was introduced throughout Austria for all motor insurance policyholders. For a long time, premiums for motor vehicle liability were regulated by the state. It was not until 1987 that this line of business was liberalised.

Another important change concerned health insurance. Since 1956, the General Social Insurance Law (ASVG) - which has been amended at regular intervals since then - guarantees all employees equal health insurance coverage. Due to this, the private insurance industry had feared sizeable losses at first, but contrary to expectations, private supplementary insurance proceeded to boom.

Life insurance still led a quiet existence in the 1960s. The exceptions were risk insurance for taking out loans and policies to cover funeral expenses. Life insurance only achieved a breakthrough in Austria when tax benefits were introduced for this form of insurance. The discussions about the financing of the state pension insurance, which had been emerging since the 1970s and 80s, then gave this line of business a further boost.

Old insurance advertising about health insurance image opens in an overlay

Old insurance advertising about health insurance image opens in an overlay

Old insurance advertising against burglary image opens in an overlay

Old insurance advertising against burglary image opens in an overlay

Old insurance advertising about life insurance image opens in an overlay

Old insurance advertising about life insurance image opens in an overlay

Old insurance advertising about accident insurance image opens in an overlay

Old insurance advertising about accident insurance image opens in an overlay

Old insurance advertising about liability insurance image opens in an overlay

Old insurance advertising about liability insurance image opens in an overlay

Old insurance advertising about life insurance image opens in an overlay

Old insurance advertising about life insurance image opens in an overlay

First expansion steps and start of the multi-brand strategy

The first steps towards expansion in Austria were taken in the 1960s. In 1964, Wiener Städtische concluded a cooperative agreement with the life insurer "Jupiter". In 1966, 40% of the shares of "Österreichische Volksfürsorge AG" were acquired. In 1971, the majority stake in "Donau Versicherung", which had already been founded in 1867, were acquired. With the management of Donau as a second brand in Austria, the foundation was laid for the local multi-brand strategy, which has been successfully pursued by the group ever since.

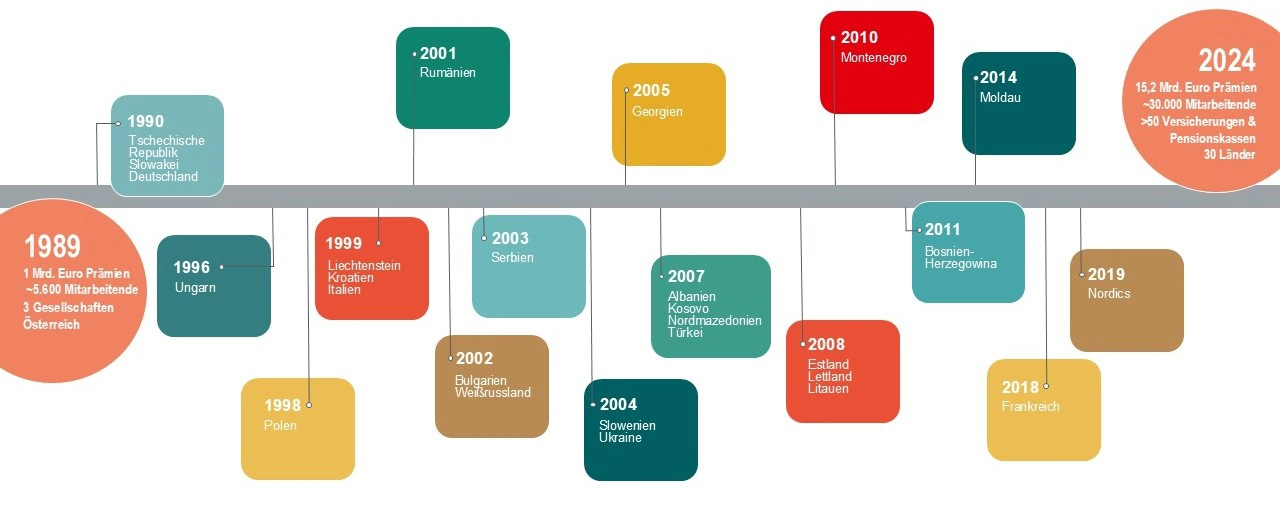

Expansion to Central and Eastern Europe

We wanted to enter these markets early because we saw huge opportunities there, but we didn't want to take too big a risk. We didn't know how things would develop there in terms of economic policy and law, and whether democracy would actually prevail in the former communist states.

We wanted to enter these markets early because we saw huge opportunities there, but we didn't want to take too big a risk. We didn't know how things would develop there in terms of economic policy and law, and whether democracy would actually prevail in the former communist states.

The fall of the "Iron Curtain" and the subsequent movements brought a general sense of optimism. The geographical location as an interface between Western and Eastern Europe proved to be a starting advantage for Austria to expand into new markets. The VIG was one of the first Western European insurance groups to take advantage of this opportunity. At the end of October 1990, Wiener Städtische participated with ATS 15.4 million (just under EUR 1.15 million) in the founding of the former Czechoslovakian cooperative insurance company “Kooperativa” in Bratislava. This was the starting signal for expansion to the countries of the former Eastern Bloc. “Kooperativa" was the first private insurance company in the reform states, and it developed very well from the beginning.

Step by step, the Group expanded to other countries in the CEE region. From 1996 to 1999, the Group entered the Hungarian, Polish and Croatian insurance markets. In the course of the following years, successful market entries followed in Romania, Belarus, Bulgaria, Serbia, Slovenia, Ukraine and Georgia. In 2007, Vienna Insurance Group further expanded its geographical presence. After entering the insurance markets of Albania, Macedonia and Türkyie, Vienna Insurance Group also became active in the three EU countries Estonia, Latvia and Lithuania. Montenegro, Bosnia-Herzegovina and, most recently, Moldova followed later in 2014.

Stock market offensive in 2004

In 1992, Wiener Städtische's insurance operations were transferred to a public limited company. This represented an important step in preparation for the planned Initial Public Offering (IPO). Wiener Städtische Versicherungsverein remained the main shareholder and limited itself to the Group's asset management.

Until 1994, Vienna Insurance Group was an unknown quantity on the international capital market. In October 1994, Wiener Städtische was listed on the Vienna Stock Exchange. Only preferred stock was listed, not common stock, and the free float was limited to a modest 11%.

Ten years later, in 2004, a major stock exchange offensive was launched. Already successfully established in Central and Eastern Europe, the opening to the international capital market took place in order to secure the necessary funds for further growth. In preparation for the capital increase, the preference shares, which were unpopular among investors, were converted into common stock. The shares were split, and in September 2005 they moved up to the ATX, the leading index of the Vienna Stock Exchange, and have been listed on the ATX without interruption ever since. VIG shares have also been traded on the Prague Stock Exchange since 2008 and on the Budapest Stock Exchange since November 2022.

Introduction of the umbrella brand "Vienna Insurance Group"

The umbrella brand "Vienna Insurance Group" was introduced at the beginning of 2006. The intention was to emphasise the unity of the insurance companies in the VIG Group. Since then, the companies have been operating in the local market with the brands (first names) already established there and all use "Vienna Insurance Group" as their family name.

Cooperation with Erste Group and acquisition of their insurance business

The cooperation between Vienna Insurance Group and Erste Group began in Slovakia in 2003 and was expanded to include the Czech Republic and Croatia in 2005. In 2008, Vienna Insurance Group acquired the entire insurance activities of Erste Group for EUR 1.45 billion. As a result, the Group achieved market leadership in Eastern Europe. In addition, a mutual distribution agreement designed to run at least 15 years was concluded. This “preferred partnership” makes it possible for both groups to use the potential client base of the other and give preference to the other’s products in sales.

The financing for this mega deal came from the capital market. With a volume of € 1.14 billion, it was the largest equity placement ever done by an insurance group on the Vienna Stock Exchange up to that time and the second largest transaction of 2008.

FORMATION of own reinsurance company

In 2008, Vienna Insurance Group founded VIG Re, a Group-owned reinsurance company in the Czech Republic. The establishment of the company, which is headquartered in Prague, sent a clear signal for the Central and Eastern European region as a core market of Vienna Insurance Group with excellent growth potential. VIG Re is now responsible not only for outward reinsurance for the VIG Group, but is also continuously expanding its third-party business throughout Europe and parts of Asia. VIG Re has had an "A+" rating with a stable outlook from Standard & Poor's since 2009.

New corporate structure

In 2010, Wiener Städtische's operating business in Austria was separated from the holding company's international activities as part of the restructuring. Since then, Vienna Insurance Group has acted as the Group's holding company and is responsible for the strategy and managing of the Group. It is also active in reinsurance and international corporate business. This way, transparent structures and processes were created within the group and more efficient management was made possible.

Extension of the cooperation agreement with Erste Group

In 2018, the cooperation agreement with Erste Group, which has been in place since 2008, was extended ahead of schedule until the end of 2033. The customers of both institutions will have broader access to each other's products. As part of a digitalisation offensive, it will be easier for customers to take out customised insurance policies more quickly. The VIG companies cooperate with Erste Group and Sparkassen in eleven countries (Austria, Czech Republic, Hungary, Slovakia, Croatia, Romania, Serbia, Montenegro, Macedonia, Bosnia-Herzegovina and Slovenia). In 2017, the merger of the bank insurance companies with the local all-line insurers of the VIG in Slovakia, Hungary, the Czech Republic and Croatia was also started and successfully completed in 2018.

Business activities expanded TO Northern Europe

In 2019, VIG expanded its business activities in Northern Europe by establishing branches in Sweden, Norway and Denmark and now offers insurance solutions to corporate customers through locally established underwriters. Finnish customers will be serviced within the framework of the freedom to provide services.

Further expansion of leading position in Central and Eastern Europe

In 2019, VIG surpassed the EUR 10 billion mark in premium volume for the first time. In November 2020, VIG signed a purchase agreement with the Dutch Aegon Group to acquire around 15 companies in Hungary, Turkey, Poland and Romania. The agreed purchase price was EUR 830 million, making it the second largest transaction in VIG's history to date. The successful acquisition of Aegon companies in Hungary and Turkey in 2022 strengthened Vienna Insurance Group's position as the leading insurance group in CEE. As a result, it became the market leader in Hungary. VIG shares were also listed on the Budapest Stock Exchange in November 2022.

Overview of the Group's development

- 24 December 1824 Foundation of the "Wechselseitige k.k. privilegierte Brandschaden Versicherungs-Anstalt" in Vienna

- 1839 Start of business activity of the "Allgemeine wechselseitige Capitalien- und Rentenversicherungsanstalt" in Vienna

- 1898 Foundation of "Städtische Kaiser Franz Joseph-Jubiläums-Lebens- und Renten-Versicherungs-Anstalt" in Vienna

- 1938 Merger of the three predecessor companies into one company

- 1947, two years after the end of the war, the company changed its name to "Wiener Städtische Wechselseitige Versicherungsanstalt"

- 1 June 1953 Start of construction and 14 June 1955 opening of the company headquarters "Ringturm" in Vienna, Schottenring 30, which is still in use today

- Expansion into an all business line insurer in the 1960s

- 1971 Acquisition of the majority shareholding in Donau Versicherung and start of the multi-brand strategy

- 1994 Start on the Vienna Stock Exchange

- 2008 Cooperation with Erste Group

- 2008 Listing of VIG shares on the Prague Stock Exchange

- 2010 Restructuring under the holding company and umbrella brand "Vienna Insurance Group"

- 2022 Listing of VIG shares on the Budapest Stock Exchange

- End of October 1990 first participation in "Kooperativa" in former Czechoslovakia

- 1990 Foundation of InterRisk in Wiesbaden (Germany)

- 1996 Entry into the Hungarian insurance market

- 1998 Entry into the Polish insurance market

- 1999 Foundation of Vienna-Life in Liechtenstein, entry into the Croatian insurance market, establishment of a Wiener Städtische branch office in Italy

- 2001 Entry into the Romanian insurance market

- 2002 Start of insurance business in Bulgaria, acquisition of an interest in Kupala, Belarus

- 2003 Start of insurance business in Serbia

- 2004 Start of business operations in Slovenia (Wiener Städtische branch) and entry into the Ukrainian insurance market

- 2005 Market entry in Georgia

- 2007 Market entry in Türkiye, Albania, Northern Macedonia and Kosovo

- 2008 Market entry in the Baltic States, founding of Group owned reinsurance company VIG Re in Prague

- 2010 Market entry in Montenegro

- 2011 Market entry in Bosnia-Herzegovina

- 2014 Market entry in the Republic of Moldova

- 2017 VIG Re establishes branch in Frankfurt (Germany)

- 2018 VIG Re establishes branch in Paris (France)

- 2019 Establishment of branches in Northern Europe (Denmark, Norway, Sweden)

A company headquarter with history and as place of encounter

In 1952, Norbert Liebermann, the General Manager of Wiener Städtische, decided to build new, modern company headquarters. Inspired by the skyscrapers in New York, the new headquarters were built as the first high-rise office building in Vienna. The architect Erich Boltenstern, who was influential in the reconstruction of Vienna after the end of the war, was responsible for the construction and part of the interior furnishing.

The first office tower in Vienna was built in a record time of only two years. During celebrations for the completion of the shell structure on 19 July 1954, the Vienna State Opera Ballet danced on the still unfinished roof of the new building. The ceremonial opening took place on 14 June 1955, less than a month after the signing of the State Treaty. In addition to representatives from politics and business and numerous international guests, many Viennese citizens also came to marvel at the city's new landmark. The Ringturm was a symbol of the modernity of the time as well as of Austria's reconstruction and economic upswing. The construction costs at the time - including the basic value - amounted to a total of around 73 million Austrian schillings.

The building, constructed in reinforced concrete skeleton, has a height of 73 metres and comprises 20 floors. To find a suitable name for the new office tower, a competition was held in 1955. The name "Ringturm" was chosen from more than 6,500 entries, and the sender received a cash prize of 2,000 Austrian schillings.

In the course of time, the Ringturm underwent general renovation and received newly designed entrances, a foyer with an exhibition centre and an event room on the 20th floor. Today it serves not only as the headquarters of the Vienna Insurance Group, its main shareholder Wiener Städtische Versicherungsverein and the largest Group company Wiener Städtische Versicherung. The Ringturm sees itself as a meeting place and place for discussion. Various events with a cultural focus and architectural exhibitions are held regularly in the foyer. The Ringturm shows the architectural heritage of the region of Central and Eastern Europe and regularly gives a broad public access to the architecture of the countries in which the Vienna Insurance Group operates.